Innovation often emerges in unexpected places. Large corporate innovation projects may receive a lot of attention and become “innovation showrooms”. At the same time, however, countless valuable resources are created for internal purposes, without a clear use case or even accidentally. Out of sight of the business, many of these technologies, data treasures or rare capabilities never get commercialized. We use the analogy of “raw gems” to discuss these neglected innovation opportunities. In this article, I outline our perspective on how raw gems can be commercialized in a fast and efficient way.

The retail giant Amazon is one of the most valuable companies in the world. Remarkably, 63% ($ 9.2 B) of its operating income in 2019 came from a business division that does not sell physical products: Amazon Web Services (AWS), the cloud services provider.[1]

Before it became AWS, the main purpose of these infrastructure services was to overcome challenges related to scaling of the internal retail operations of Amazon.com. AWS is a great example how internal capabilities can almost by accident evolve to become a highly valuable source of revenue.[2] I have come to believe, however, that AWS is the exception rather than the rule, and that many opportunities never get seized. What a waste.

1. Commercializing Raw Gems

Discussions with our clients and network partners imply that there are enormous hidden treasures in the attics and storerooms of established companies – waiting to be found and polished. These “raw gems” can be a new technology, a rich but unused set of data, a rare physical assets or a unique skill. It may even be a special relationship with certain customers or stakeholders.

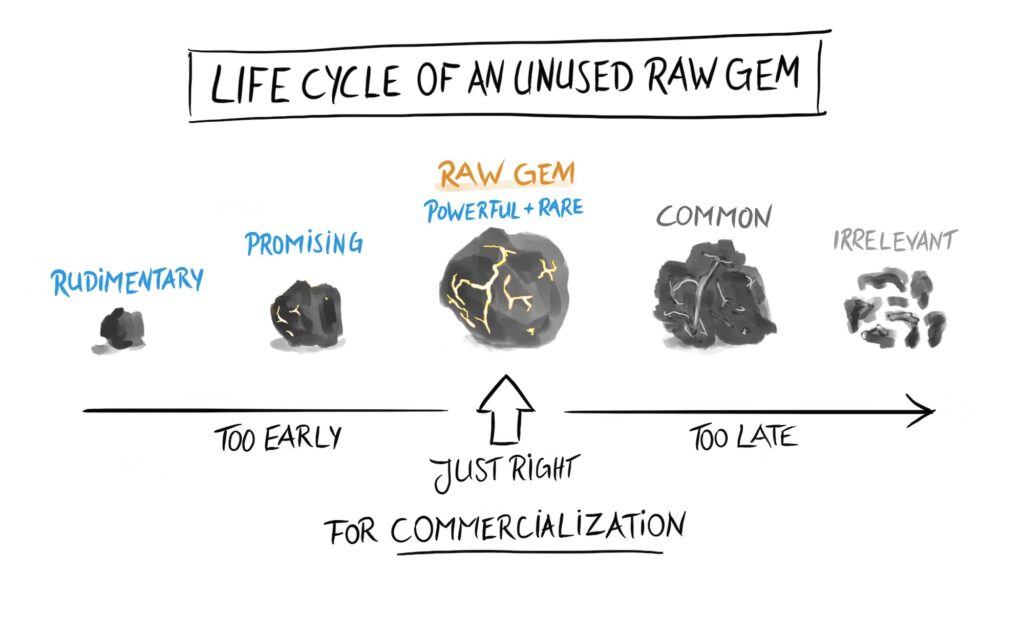

The lifecycle of such resources can be imagined like illustrated in figure 1: In the beginning, the resource will be rudimentary and probably not very valuable. Over time, some resources become promising (represented by the emerging magical glow) although it may still be too early for commercialization. In stage three, the “raw gem” is ready to be commercialized. It now needs to be cleaned, cut and polished according to the needs of the target group. If that doesn’t happen – for whatever reason – the resource will eventually become common as other organizations are developing the same or equivalent resources. It may still be useful for internal purposes but is no longer valuable to external customers. In the final stage, the resource becomes irrelevant and should be removed or replaced.

Figure 1: Life cycle of a „raw gem“

Admittedly, few research results or internal assets will have the potential to create a business on the scale of AWS. In many cases, potential customers will not even consider these raw gems to be of any value at all – not in their original form. Hence, a key challenge is to find out whether – and to whom – the presumed raw gem might be worth something. Consider the example of a recent project we have done together with Heidelberg Technology Park for NEC Laboratories Europe, a research organization of the Japanese electronics giant NEC.

In a project called SOL, NEC Laboratories Europe has developed a technology for machine learning that can significantly accelerate the training and inference times of neural networks (for more details about the technology visit the project website). At the beginning of our assignment, the technical performance of that technology was already undisputed (to the technical experts, the “magical glow” was clearly visible). It was not yet clear, however, in which ways the technology could create value in the external market. Jürgen Quittek, Managing Director of NEC Laboratories Europe GmbH, recognized that SOL needed a real push towards commercialization, which it actually received: “It was surprising to see how quickly the team was able to assess the potential value of the technology by coming up with a Minimum Viable Product that could be tested with customers.” The team consisted of two scientists from NEC, two colleagues from Heidelberg Technology Park to leverage experience from the start-up domain, and my colleagues Frank Rust and Marius Schmidt from SOMMERRUST to provide their business model and innovation expertise. In a fast, structured approach, the team explored a wide range of potential customer groups, developed marketing material to test the value proposition and explored different business model options.

Many innovation professionals will feel a bit uncomfortable with an approach that starts with a solution.

Many innovation professionals will feel a bit uncomfortable with an approach that starts with a solution, searching for the problem to be solved. After all, user-centered innovation methodologies like Design Thinking preach the precedence of user needs. They reject the notion of developing anything without a clear use case for the customer.

While I would principally agree, the starting point here is that the technical solution is already there. It can either be commercialized, or not. What is important, however, is that the team is willing to “reconfigure” the solution/resource and its value proposition in order to create a compelling product. Hence, we reverse-engineer the default innovation process in the sense that customer discovery happens as if there was no solution yet. If the existing resource can be transformed into a useful product with reasonable effort, the project continues. If no strong customer need is identified that is compatible with the existing resource, the project is terminated.[3]

2. Raw Gem Discovery

By now you are hopefully wondering which raw gems might be hidden in your own corporate storerooms. But where exactly should you to look for them? First of all, you need to remember that the raw gems I refer to were either not developed for the purpose of generating revenue or lack any clear way of doing so. Currently, it may therefore be no one’s job to leverage their potential for commercialization. You may need to do some detective work and follow the “aw” (as in awesome or awful). Talk to people inside your organization – if it’s a raw gem, some people will usually rave about it while others consider it an awful business idea or fail to see its true potential.

Do some detective work. If it’s a raw gem, some people will find it awesome while others consider it an awful business idea

Raw gems may emerge in different ways, for example:

- R&D came up with some cool technology, but the organization is too far away from potential customers to identify a clear use case.

- A resource was developed for internal purposes and is owned by a support function (i.e., a cost center). Tapping into new revenue sources is not in scope of that unit.

- The company tried to exploit the resource in the past but commercialization failed (wrong target group, wrong value proposition, or wrong timing). Some of these projects turn from “pets” into “zombies”. These futile projects are kept alive although they no longer have a realistic chance of achieving their original objectives. Through smart validation and reshaping, however, they may see the long-awaited breakthrough.

3. Raw Gem Validation

Once you have identified a candidate for a raw gem, you need to evaluate its market potential. Based on our experiences with NEC and other projects, we propose a 3-step approach to assess a suspected raw gem fast and reliably (see figure 2): 1) Uncover the playing field (“clean the gem”), 2) Shape the value proposition (“cut the gem”), and 3) Prototype the product (“polish the gem”). The analogy with industrial production lines refers to the great efficiency with which innovation opportunities can be validated.

Figure 2: The 3-step „Validation Line“ for innovation opportunities

Step 1 – Uncover the playing field (“clean the gem”): In order to explore the full potential, the team first needs to understand the playing field, i.e. where and when the raw gem could be useful. You can use a fast version of the scenario methodology (e.g., a Scenario Sprint) to explore the opportunities in time and space:

- Space: the opportunities that exist for the raw gem inside the core (i.e. with current customers) versus at the periphery of the company (e.g., within adjacent industries)

- Time: the opportunities that exist today versus in the future

This step will provide you with a sense of how broad the opportunity actually is (optionality), and whether the window of opportunity might be closing fast or does not open up until in a couple of years’ time. One outcome of the analysis could be that the resource is valuable now for existing as well as new customers, and that it will become even more precious in the future – a great outcome. The value of the resource might also differ depending on the future scenario. Or, it may generally diminish over time, implying that minimizing time-to-market should be a top priority. The good news is: whatever the result of this step, you can reuse most of the scenario work for other potential raw gems as long as they relate to the same playing field.

Step 2 – Shape the value proposition (“cut the gem”): The goal of this step is to generate concrete ideas for relevant use cases and to do a first reality check. The team taps into its network of business practitioners (e.g. investors, entrepreneurs or industry experts) who are active in the relevant fields that emerged during step 1. The solution gets exposed to their judgement and imagination via interviews and/or pitch events. At the end, the team has a clear view on who could benefit from the raw gem in what way. The customer-specific solution takes shape and we can formulate a precise value proposition. Moreover, the team develops a sense for the magnitude of the economic opportunity (we refer to this opportunity sizing as the “Innovation Case”).

Step 3: Prototype the product (“polish the gem”): Until this point, all we’ve got is a value and growth hypothesis (although hopefully a well-founded one). This last step is therefore about testing the identified use case(s) with real customers. To do so, the team creates a polished “fake” product that can be discussed with a potential customer like a real offering. Because the raw gem already exists, this step is much easier to do on a sophisticated level than with new products that are developed from scratch. In the case of the SOL project, it was possible to do a live demo with the actual technology. The team also built a product website to validate demand via Google Adwords and created product brochures to test the value proposition.

In the best case, the team concludes this step by acquiring the first actual customers. In the worst case, the team now understands why the raw gem is actually of limited value and can reuse the generated learnings for future innovation efforts or improve existing offerings to better meet the needs of the customer.

4. Where to begin

For NEC Laboratories Europe, a systematic way to identify and commercialize raw gems represents a big opportunity. “We are successful at developing original fundamental technology and generate many publications in top-tier journals. However, the full business potential of new technologies is often well concealed and difficult to capture for a research organization like us. Therefore, collaborating with market-oriented innovation partners is key.” remarks Jürgen Quittek. Through the new partnership with SOMMERRUST and Heidelberg Technology Park, NEC Laboratories Europe now intends to exploit these untapped opportunities from raw gems more systematically in the future.

If you now want to start digging for raw gems yourself – technology or otherwise – how should you start?

I suggest you ask yourself what your company can do particularly well – something that sets you apart from competitors or other industries. Then, call some of your researchers or engineers and ask them about the last thing that really got them excited (but that no one else in the company seemed to care much about). Talk to someone e.g. from IT or HR. Ask them about their work: what are they particularly proud of? Ask colleagues in the line business about zombie projects or failures that caused a lot of unanticipated disappointment.

If you are lucky, the answer you get is a raw gem…

_____

Endnotes:

- Amazon (2020): 2019 Annual Report, p. 25. Downloaded on June 18, 2020 from https://ir.aboutamazon.com/annual-reports-proxies-and-shareholder-letters/default.aspx

- For a more detailed account of how AWS emerged see https://techcrunch.com/2016/07/02/andy-jassys-brief-history-of-the-genesis-of-aws/

- Please note that stopping the commercialization process should not be considered a failure. For one, this decision will prevent the company from wasting further time and resources on the topic. Maybe more importantly, there will usually be significant value in the generated learnings as a by-product: a new customer need may be discovered, novel means of improving existing offerings may surface, or a new product idea could be conceived by the team.

All images by Axel Sommer © SOMMERRUST 2020